Responsible investment manager Downing LLP is providing a £9m loan to support a new property development in Bordon, Hampshire.

The deal marks Downing’s continued expansion in the property sector despite challenging market conditions.

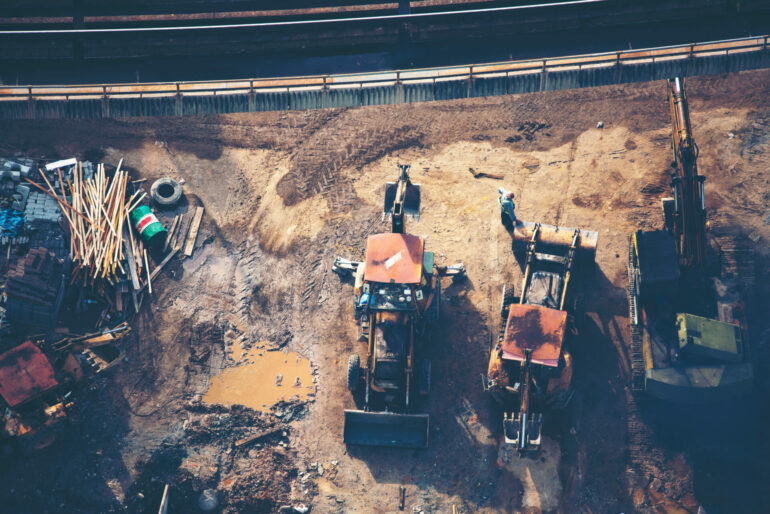

The development comprises the construction of 56 houses and 22 flats on a major regeneration site, which has already seen significant development by national housebuilders.

Downing’s Property Finance team deploys funds from investors as secured loans to property developers working on residential-led schemes nationwide, as well as non-speculative commercial developments and specialist sub-sectors such as student accommodation. Investors can benefit from debt investments secured against property development projects, targeting attractive yields through a “safety-first” lens and focusing on relationship-based sourcing and working with experienced counterparties.

Parik Chandra, partner and head of specialist Lending at Downing LLP, said: “We are continuing to grow the portfolio in very tough macro conditions and a competitive market.

“We remain committed to supporting SME developers in the face of challenging conditions. We’re delighted that the houses and flats will be a mixture of styles and sizes, serving a broad range of buyers – from families to first-time buyers.”

Downing LLP typically lends between £1m and £25m to experienced developers, with the capacity to go higher by exception. The firm lends up to 90% loan-to-cost and 70% loan-to-gross-development value.