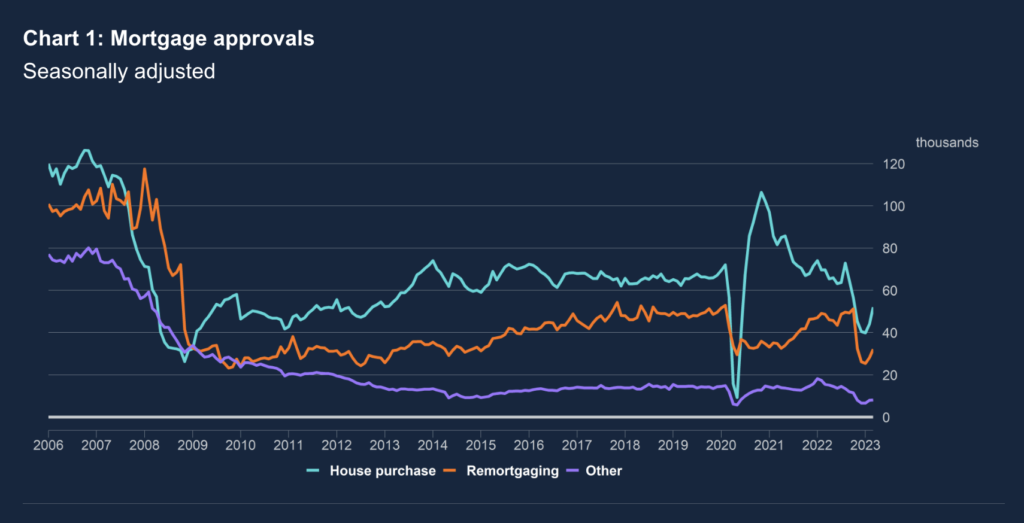

The Bank of England’s Money and Credit statistics for March reveal a significant increase in net approvals for house purchases and remortgages, despite individual mortgage debt borrowing falling to its lowest level since June 2011, excluding the Covid-19 pandemic period.

Net borrowing dropped to zero, down from February’s net flow of £0.7bn and July 2021’s £1.8bn of net repayment.

A noteworthy aspect of the statistics is the significant rise in net approvals for house purchases, an indicator of future borrowing.

Net approvals increased to 52,000 in March, up from 44,100 in February, although this figure remains below the monthly average for 2022 of 62,700.

Similarly, approvals for remortgaging with a different lender also experienced an increase, reaching 32,200 in March, up from 28,200 in February. These increases suggest positive momentum in the mortgage market despite the decline in individual mortgage debt borrowing.

The effective interest rate on newly drawn mortgages rose by 17 basis points to 4.41%, while the rate on the outstanding stock of mortgages increased by 9 basis points to 2.73%.

Commenting on the Bank of England’s statistics, Steve Seal, CEO of Bluestone Mortgages, highlighted the increase in mortgage approvals as a “glimmer of hope” for the recovering mortgage market. However, with the Bank of England potentially raising interest rates for the twelfth consecutive month, affordability challenges remain a concern for borrowers and prospective buyers.

Seal reassures those struggling with mortgage repayments or concerned about entering the property market, saying, “For those struggling to keep up with mortgage repayments or worried about how to climb onto or up the property ladder, remember that help is always at hand.

“There are brokers and specialist lenders whose ultimate role is to ensure customers and borrowers feel supported in times of uncertainty and point them in the right direction so that they too can achieve their homeownership dream.”

Further reaction

Mark Harris, chief executive of mortgage broker SPF Private Clients:

“With mortgage approvals picking up again, it appears as though buyers are shaking off recent concerns about the wider economy and getting on with moving.

“The average rate on new mortgages continued to rise in March, increasing by 17 basis points to 4.41%. The worst of the pain may not be over with another quarter-point rate rise expected next week as inflation proves to be more stubborn than the Bank of England expected.

“The recent rise in Swap rates, which underpin the pricing of fixed-rate mortgages, has resulted in lenders removing their market-leading lower loan-to-value products, with all the main players increasing pricing by 0.30%. However, Swaps have plateaued over the past few day and started to edge downwards so if this trend continues, we expect sub-4 per cent pricing to return once again.”

Jeremy Leaf, north London estate agent and a former RICS residential chairman:

“We regard mortgage approvals as a very useful indicator of future direction of travel for the housing market and these figures are no exception.

“Lending was in the doldrums, reflecting the quiet period between the mini-Budget and the end of last year, whereas the approvals figures illustrate that stabilising mortgage rates and inflation is prompting an increase in activity.

“Nevertheless, buyers have recognised that the balance of power is shifting their way. As a result, it is generally only those sellers who understand the importance of realistic pricing who are succeeding.”

Paul McGerrigan, CEO at fintech broker Loan.co.uk:

“It is encouraging to see mortgage approvals for house purchases increase significantly this month, after net lending dropped dramatically in February. Approvals for property purchase have jumped to 52,000 from 44,100 in February. To put this in context however in February 2020 this figure was 73,500.

“It doesn’t take an expert to realise that rapidly increasing interest rates are impacting the property market considerably, members of the Bank of England’s Monetary Policy Committee remain stuck between a rock and a hard place when they meet next week.

“It can take 18 months for monetary policy to work its way into the system to curtail inflation but can take only weeks to impact the property market. It feels like time for the MPC to hold rates and allow the borrowers (and the market) the chance to breathe and settle into a more normalised state.”

Kevin Dunn, mortgage and protection adviser at Leicester-based financial planner and mortgage broker, Furnley House:

“In March and April, we saw mortgage approvals bounce back sharply despite base rate increases and stubbornly high inflation. That seems to be evidenced by this data. Mortgage approvals for house purchases are certainly not as high as they were a year ago when rates were ultra-low but they are now at, or around, their pre-pandemic level. The reason for this is that buyers have now adjusted to the higher interest rate world and there is also a lot more confidence in the economy. We’re also seeing a good number of clients engaging early with their brokers when their deal ends, too. The new mortgage rate environment has made borrowers a lot more proactive.”

Kim McKinley, director at Lee-on-the-Solent-based Vibe Specialist Finance:

“After last September’s mini-Budget, mortgage approvals dropped off a cliff but in the first quarter of 2023, confidence steadily returned as mortgage rates came down and the economic outlook felt less bleak. The significant increase in mortgage approvals for house purchase in March reflects the improved sentiment on the ground and the fact that people have accepted the new rate environment and are getting on with their lives. All in all, the UK economy is not looking as bad as the market predicted towards the end of 2022 and that sentiment is feeding through into mortgage approvals. Even another increase in the bank base rate this month may not slow the rise in mortgage approvals in the months ahead.”

Gary Bush, financial adviser at the Potters Bar-based MortgageShop.com:

“In the first quarter, mortgage approvals were far higher than we expected at the tail end of last year following the mini-Budget. We thought it would be active but totally underestimated how active. March was busy, as shown in this data, but April saw activity that made us creak at the seams. Buyers have factored in all the doom and gloom rate news and a lot have quite frankly put off buying a property or a home improvement decision for so long that they are now out in force. This may explain the latest Nationwide growth figure in April, of 0.5%. We expect the second quarter of the year to continue to show some impressive activity regardless of the 11th May Bank of England rate decision.”

Ashley Thomas, director of London-based mortgage broker, Magni Finance:

“We have seen a huge increase in enquiries over the past couple of months with more and more people looking to move ahead with purchases. March and April saw a growing number of prospective house buyers put the pedal to the floor. The property market seems to be much more positive as mortgage rates have continued to reduce over the past couple of months.”

Kundan Bhaduri, director of London-based property developer and portfolio landlord, The Kushman Group:

“Based on this mortgage approvals data, the UK housing market is on the move again, with house prices also rising by 0.5% in April, according to the Nationwide. Now that the fallout from the mini-Budget has largely subsided, and people sense the economy may hold up better than originally thought, buyers are once again emerging and eyeing up potential properties. I spoke to a first-time buyer recently who had been holding off on buying a home, waiting for the right time. With mortgage rates lower than expected and a growing sense of confidence in the economy, they finally took the plunge and bought their dream home. It’s a reminder that, while there are certainly challenges ahead, the housing market can still offer opportunities for those willing to take the leap.”

Lewis Shaw, founder of Teesside-based broker Riverside Mortgages:

“Despite the omnishambles of the mini-Budget, our transaction levels have held steady, if anything increasing a touch due to anxious mortgage holders reacting to media reports of a collapse of house prices and mortgage armageddon. March was active while April was one of our busiest months for some time, with May quickly shaping up to deliver more of the same.”

Rhys Schofield, managing director at Derbyshire-based mortgage advisers, Peak Mortgages and Protection:

“March was a steady month in the mortgage and housing market for us, but in April things picked up further. Costs and higher mortgage rates are clearly a concern for many but you can’t escape the reality that people need homes to live in so I’d expect to see mortgage approvals tick up further throughout the year along with modest house price growth.”

Graham Cox, founder of the Bristol-based broker, SelfEmployedMortgageHub.com:

“After February saw the first increase in mortgage approvals in six months, a further rise in March was always likely, but few would have expected this spike in approvals. We certainly saw a noticeable improvement in buyer interest in March and April. The traditional peak buying period in Spring and Summer should see approvals rise steadily but they are likely to remain 20%-30% below where they were in the same period last year. And with more base rate hikes expected, demand is likely to remain weak for the foreseeable.”

Tomer Aboody, director of property lender MT Finance:

“Higher mortgage approvals in March show that there is slightly more confidence in the market which is cemented by the Prime Minister’s push for lower inflation and the markets predicting lower long-term rates than first indicated.

“However, while rising, transactions are down compared with before the pandemic so some assistance from the government to try to push volumes is now required.”

Adam Oldfield, chief revenue officer at Phoebus Software:

“The increase in approvals for house purchases was substantial and the best sign yet that the housing market has turned a corner. Add to that the latest report that house prices increased in April and the picture is significantly better than we may have hoped a couple of months ago. However, the potential of rising mortgage rates will still be weighing heavy for many and the number of buyers willing to take the plunge may not be as great as the number of properties coming to market. At the moment it appears to be a buyers market, which may well have an effect on house prices in the coming months.

“The possibility of another interest rate rise when the MPC meets next week will be in the back of many minds, but the attitude seems to be one of determined optimism at the moment. Whether that will be the case if rates and everyday living costs continue to rise remains to be seen. It will be incumbent on lenders to ensure that borrowers are aware of how they may be affected down the line. Luckily for most the original stress testing limits should mean that affordability won’t be an issue at current rates.”

Carl Howard, Group CEO of Andrews estate agents:

“This striking bounceback in mortgage approvals shows confidence has been restored in the property market.

“Buyers who had put their search on hold are now reigniting their hunt for properties in line with spring market expectations.

“Lenders continue to flex their rates depending on their appetite, which is largely driven by their ability to deal with demand, but we have seen more sub-4% products.

“It’s clear that more buyers are returning to the market. As a result we are seeing an increase in demand and house prices appear to be stabilising.

“For those waiting to see what happens with rates, it’s clear that lenders are not going to give much more away. But these are positive first steps towards a more normal, stabilised market.

“Sadly, prospect first-time buyers and those holding out for further price reductions may have missed their window.”

Charlotte Nixon, mortgage expert at Quilter:

“New statistics today paint a mixed picture for the housing market, with mortgage lending to individuals experiencing a significant drop, reaching the lowest level since June 2011. This decline will be down to persistently high inflation, the elevated cost of living, and rising interest rates, which have placed considerable strain on household budgets.

“However, net mortgage approvals for house purchases have shown resilience in the face of these issues, increasing to 52,000 in March from 44,100 in February. This increase could be linked to a modest rise in consumer confidence, as individuals grow accustomed to mortgage rates around 4.5% and a predicted path to a base rate peak of 5%. This is also likely a result of the usual uptick in house purchases in spring.

“However, with a base rate hike likely on the cards next week this new found optimism for buyers might be quickly dampened. Whether these increases are enough to completely rain on a usually more buoyant market in the spring and summer months is yet to be seen.

“Despite the cost of living crisis stretching budgets each month, £3.5 billion was deposited into National Savings and Investment (NS&I) accounts in March, the highest since September 2020, a time when some people had more money to save due to an inability to do much else because of lockdown. This uptick in savings suggests individuals are seeking more secure saving options and are taking advantage of higher interest rates.

“In light of these varying economic factors, it’s essential for individuals to carefully consider their borrowing and saving strategies. With fluctuating interest rates and mortgage approvals, prospective homebuyers and existing homeowners should seek professional advice to make informed financial decisions tailored to their unique circumstances, as the market continues to grapple with the multitude of challenges.”

Simon Webb, managing director of capital markets and finance at LiveMore:

“Mortgage lending was flat in March with net borrowing at zero. This is the seventh fall in as many months and the lowest level in 12 years if you exclude the Covid pandemic lockdown.

“However, both house purchase and mortgage approvals increased during the month, so we can take some comfort that the market is moving. This is backed up by estate agents reporting an increase in both buyers and sellers and more houses are becoming available. The indications are that mortgage lending will slowly pick up in the second quarter of this year as will housing transactions.”

John Phillips, national operations director at Just Mortgages:

“It is certainly encouraging to see net mortgage approvals – an indicator of future borrowing – increase for the second month in a row. This certainly mirrors the activity reported by our brokers across the country as more clients continue to get their purchasing plans back on track.

“Since the start of the year we’ve seen consistent levels of buyer registrations and strong demand for valuations and appointments. This has even been the case during the February half-term and subsequent bank holidays which can typically be a quieter period. In all parts of the country, customers are keen to seek advice and find out what the market actually looks like for them and their situation. To maintain this positive momentum, brokers must be on the front foot and getting in front of as many clients as possible to highlight how the market has changed in just the last month, let alone since the start of the year.

“Remortgaging will continue to be clear priority as we head further into the year. At Just Mortgages alone, it has gone from 44% of our total mortgages in Q1 2022, to 57% in Q1 2023. As more mortgages mature and borrowers weigh up their options, it’s right to expect that figure to increase. The proactive brokers will be targeting their marketing and pounding the pavement to communicate with the large number of borrowers still to secure the best possible rate.”

John Phillips, national operations director at Just Mortgages:

“It is certainly encouraging to see net mortgage approvals – an indicator of future borrowing – increase for the second month in a row. This certainly mirrors the activity reported by our brokers across the country as more clients continue to get their purchasing plans back on track.

“Since the start of the year we’ve seen consistent levels of buyer registrations and strong demand for valuations and appointments. This has even been the case during the February half-term and subsequent bank holidays which can typically be a quieter period. In all parts of the country, customers are keen to seek advice and find out what the market actually looks like for them and their situation. To maintain this positive momentum, brokers must be on the front foot and getting in front of as many clients as possible to highlight how the market has changed in just the last month, let alone since the start of the year.

“Remortgaging will continue to be clear priority as we head further into the year. At Just Mortgages alone, it has gone from 44% of our total mortgages in Q1 2022, to 57% in Q1 2023. As more mortgages mature and borrowers weigh up their options, it’s right to expect that figure to increase. The proactive brokers will be targeting their marketing and pounding the pavement to communicate with the large number of borrowers still to secure the best possible rate.”