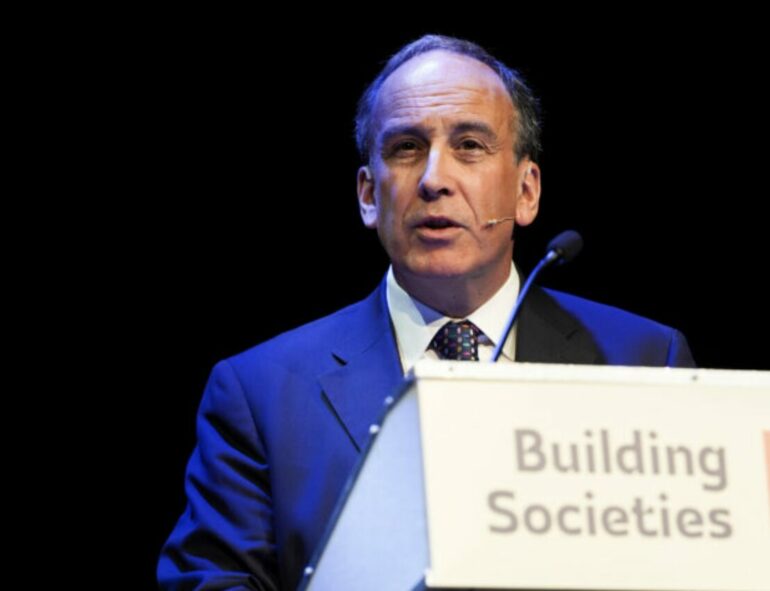

At the Building Societies Annual Conference in Manchester, Robin Fieth, chief executive of the Building Societies Association (BSA), unveiled an ambitious plan to double the membership of UK building societies over the next decade.

Currently, the 42 UK building societies and seven of the largest credit unions collectively serve over 26 million customers with assets totalling more than £507bn. The BSA aims to increase this number to 52 million by 2034.

This target aligns with the Labour Party’s commitment to expand the co-operative and mutual economy, regardless of the upcoming general election results.

Building societies are advocating for a “mutuals first” approach in government policymaking, seeking a legislative and regulatory framework that allows them to compete on equal footing with shareholder-owned companies.

During the conference, Fieth explained that a significant increase in membership could be supported by enhancing household financial resilience through workplace savings.

The BSA is calling on the government to mandate auto-enrolment into workplace savings schemes for organisations with more than 250 employees, aiming to bolster the sector’s role in societal improvement.

Next year marks the 250th anniversary of the first building society. Fieth highlighted the sector’s historical commitment to benefiting local communities and the broader society, a mission that remains at the heart of their operations as they look to expand and evolve further.