The Building Societies Act 1986 (Amendment Bill) successfully completed Parliamentary stages today (Friday 24th May) to become one of the final Bills to pass this Parliament.

In a move welcomed by The Building Societies Association (BSA), this Act of Parliament was created to help enable building societies to support more lending to first-time buyers and homeowners in the future.

Recent research revealed that building societies accounted for a quarter of all new mortgage lending in the UK, and directed a greater proportion of lending to first-time buyers than banks.

In the first nine months of 2023, 55% of all building society lending for property purchases was to first-time buyers, supporting over 70,300 households to buy their first home.

Under the existing Act, member-owned building societies are required to raise at least 50% of their funding from members’ savings deposits.

This ‘funding limit’ is an important feature of the building society model, as it preserves their mutual status.

However, other types of funding, taken from the financial markets or from the Bank of England, also count toward the funding limit, constraining building societies from competing more effectively with the UK banks.

The BSA said amending the Act would enable building societies to have more capacity to lend to UK customers, and to access emergency funding from the Bank of England in a time of financial stress, without it impacting funding limits.

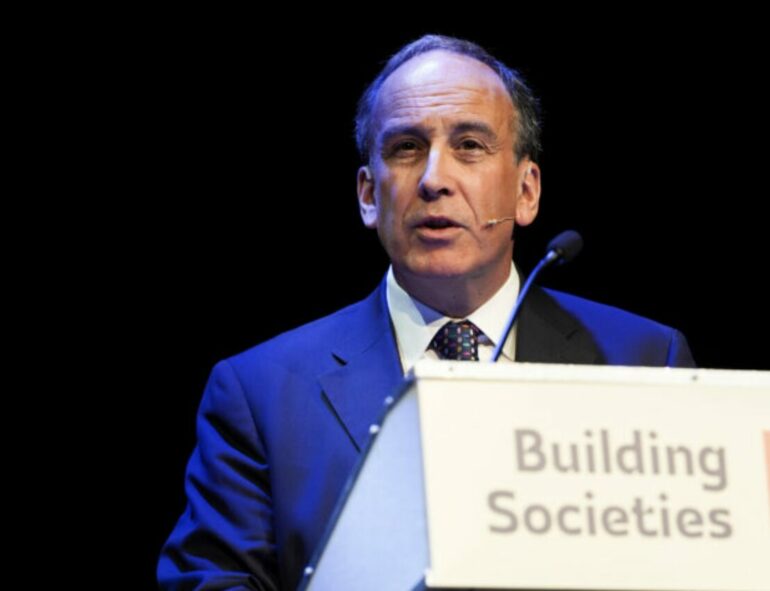

Robin Fieth (pictured), chief executive of the BSA, said: “The fact that this Bill has been able to successfully complete the necessary Parliamentary stages as part of wash up is testament to the strong cross-party support for building societies and the important role they play in our communities.

“Our thanks to Julie Elliott MP, who introduced this Bill, to Lord Kennedy of Southwark who took it through the Lords and to Economic Secretary to the Treasury Bim Afolami MP and his team at HM Treasury for all their support in ensuring it made it to the statute book.”

“The new Act will help level the playing field for the UK’s building societies and give them the capacity to lend more into the economy. It’s high time the 1986 Act was updated to reflect the needs of today’s economy.

“The changes brought in by this new Act will drive greater competition in the mortgage market, which will give mortgage customers more choice, and support a healthy marketplace.”