Despite the increases to the Base Rate demand for homes strengthened in February, according to the latest RICS Residential Market Survey.

A net balance of 17% of survey participants said they had seen a jump in new buyer enquiries.

This is the sixth time in a row an increase has been reported and the strongest it has been over this period.

At the same time, the number of agreed sales improved, with a net balance of 9% saying sales of homes were increasing and providing the strongest reading since May 2021.

Declining new sales instructions coming onto the market also appeared to stabilise in February, with only 4% of respondents saying they had seen a fall (less than -7% in January).

Stock levels remain close to historic lows however and are still a major factor in sustaining house price inflation.

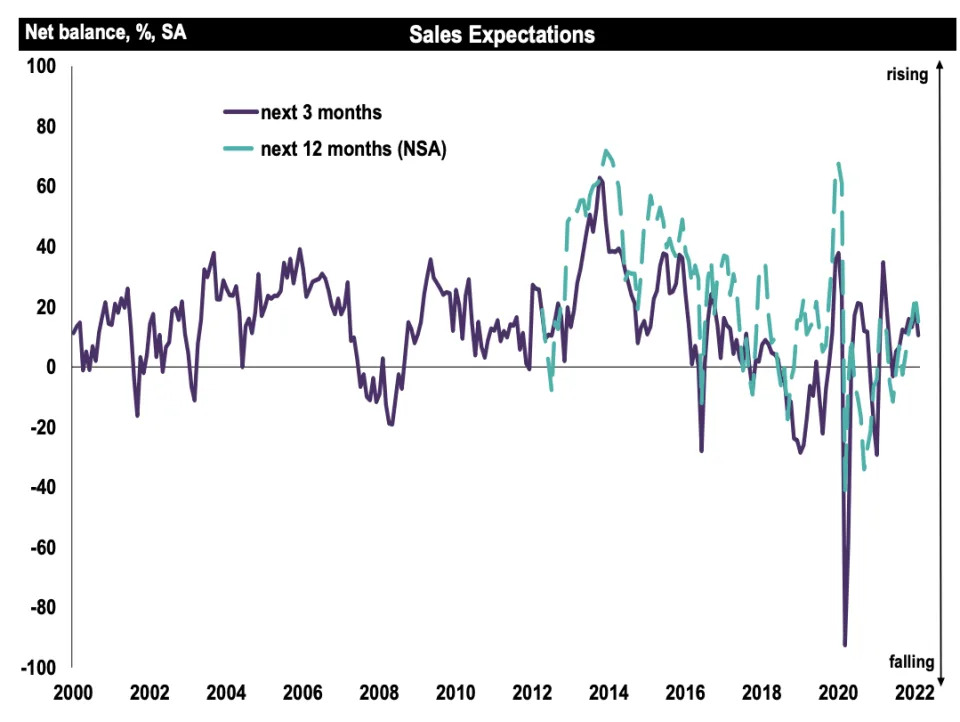

Looking to the next three months, RICS predicts sales to increase, albeit at a more modest pace – with a net balance of 11% (down from 20% in January).

Looking further ahead respondents remained positive with sales expected to remain on an upward trajectory over the coming year.

Looking ahead, RICS expects sales to increase in the next quarter, although at a slower pace. Respondents also expect sales to remain on an upward trajectory over the coming year.

Respondents anticipate a further rise in house prices both at the three and 12-month time horizons.

Simon Rubinsohn, chief economist at RICS, said: “Huge clouds of uncertainty hang over the economic prospects as energy prices continue to surge and the BoE grapples with how to manage monetary policy in this challenging environment.

“Despite all of this, there is little evidence yet that the mood music regarding the expectations for house prices or rents is shifting. Indeed, the medium-term projections from respondents to the RICS survey are continuing to gain momentum.

“It may well be that these trends ease as the deteriorating macro environment begins to bite but the message that keeps recurring, both for sales and lettings, is there are in aggregate many more prospective purchasers and renters than properties available.”

Tomer Aboody, director of property lender MT Finance, added: “With the simple message of demand outstripping supply, house prices continue to rise although in a more modest fashion. This is understandable considering the increases we have seen in the past 18 months – the highest in more than 15 years.

“With interest rates continuing to rise in order to curb inflation, buyers are looking to make their move as soon as possible in order to lock into affordable long-term mortgage deals.

“Many are prepared to stretch themselves to bid higher than they otherwise would have done in order to secure that dream home.

“Confidence continues to prevail despite many potential threats such as the war in Ukraine, rising energy bills and possible continued lack of supply of materials, which will have an effect not only on prices but also result in delays to any works carried out on homes.

“Buyers are therefore tending to bid higher prices on properties which do not need much work, taking advantage of high leveraged mortgage products.”

Jeremy Leaf, north London estate agent and a former RICS residential chairman, warned a lack of options were still constraining activities: “Despite recent modest improvements in stock levels, partly prompted by worries prices may be peaking after increases in inflation and interest rates, lack of choice is constraining activity.

“Events in Ukraine and inevitable even higher-than-expected energy prices are helping deepen those concerns and scaring those on limited budgets – often first-time buyers.

“The net result is a reduction in activity and softening – not correction – in prices due to the continuing shortage of houses in particular.”