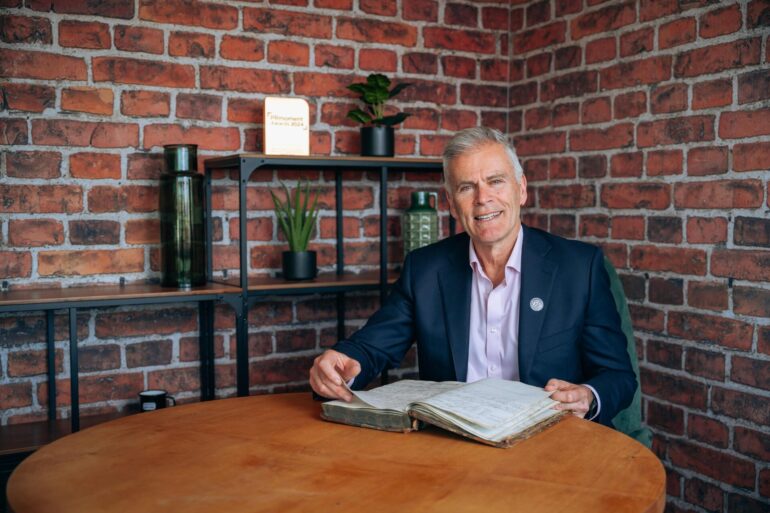

The Cumberland Building Society has announced that Des Moore (pictured), current chief executive officer, will step aside from his role in summer 2026, after eight successful years with the organisation.

Moore was appointed in 2018 when The Cumberland was in need of a new strategic direction.

Under his leadership, The Cumberland’s balance sheet has grown by 32% since 2018.

Internally, he has worked closely with the senior management team to build a more empowered and values-led culture that puts people, community, and the planet at its heart.

This includes improved colleague benefits and paying the Real Living Wage.

There has also been significant progress in leadership diversity, with women now holding 50% of senior leadership roles increased from 19% in October 2018.

Moor said: “It has been a privilege to lead an organisation that does so much good for others, especially one that has been trusted by its members for 175 years.

“Our people are ‘off-the-scale’ passionate about what we do, and our success is down to them; I’ve been very lucky to lead an exceptional executive team during this time.”

He added: “When people hear the name, The Cumberland, it resonates with them. We’ve built something deeply connected to the community, and I’m proud of the legacy we’ve created together.

“Having seen The Cumberland through its 168th, 170th and now 175th anniversary, I’m glad to say it remains true to its roots: purpose-led, socially responsible, and committed to our communities. It’s perfectly captured in our Kinder Banking purpose.”

In more recent times, Moore has overseen The Cumberland’s largest ever investment as it undertakes a digital transformation to modernise its services and better meet and better meet customer needs.

In a strategic partnership with Tata Consultancy Services (TCS), The Cumberland is modernising its core technology platforms with TCS BaNCS™ for Core Banking, TCS Digital Home Lending Solution for Mortgages, and Quartz for Compliance.

The new banking solution aims offer greater flexibility in how customers choose to manage their finances – whether online, by phone, or in branch.

He added: “Deep change takes time to implement, and the technology investment was the last big piece of the current puzzle. Now, is the natural moment for someone else to take the baton to solve the banking puzzles of the future.”

Moore will remain in post until summer 2026, supporting an orderly transition to new leadership.