The cost of renting a home has reached nearly £1,000 a month as rents rise at their fastest pace for 14 years, according to the latest Rental Market Report from Zoopla.

Newly agreed rents averaged £995 a month at the end of March, £88 more per month than at the start of the pandemic.

The jump is being driven by a shortage of properties to rent at a time when demand is soaring in city centres as students, office workers and international buyers make their return.

But the rental market remains highly localised, and there are still locations where rental properties remain affordable, particularly in rural areas of the country.

As renters face increased pressure on their income due to rises in the cost of living, there has been a marked increase in people staying where they are.

The typical renter now stays in their home for 75 weeks – five months longer than in early 2017.

This trend has extended beyond Covid-19 lockdowns, when moving was difficult, and indicates landlords may not be increasing rents for their existing renters at the same rate as for new ones.

What’s happening to rents?

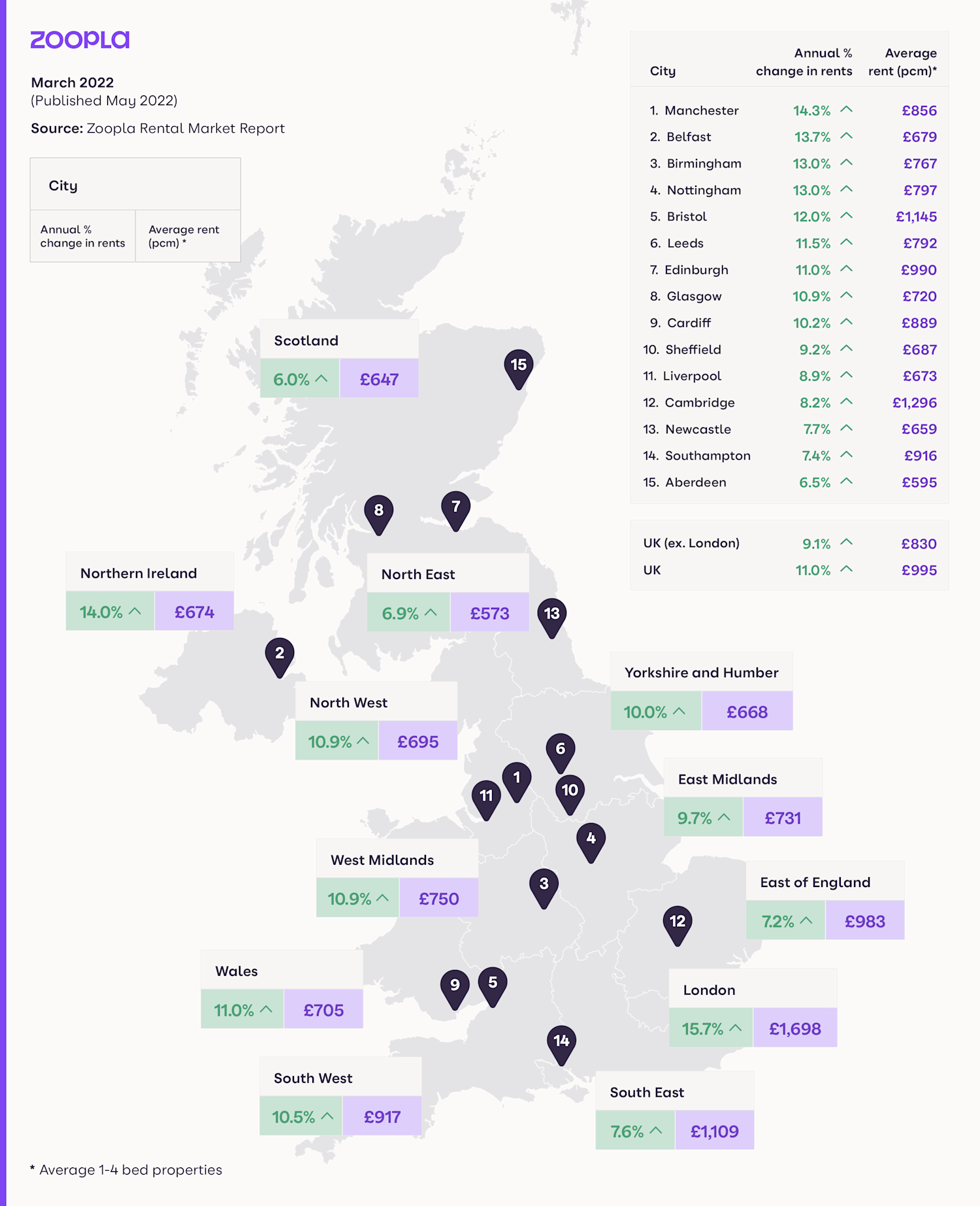

Rents increased by 11% for newly agreed lets during the past year, after falling by 1% during the previous 12 months.

Increases have been highest in London, where they have soared by 15.7% in the year to the end of March, more than offsetting the previous drop of 10%, on the back of rising demand from students, office workers and people from overseas.

But at the other end of the scale, rents have increased by only 6% in Scotland and 6.9% in the North East, with rents in the latter region averaging just £573 per month.

The jump in rents has left the average single renter spending 37% of their income on housing, and 18.5% for people who share a home, after wage growth peaked at 8.8% last year.

The proportion of income spent on housing jumps to 52% for single renters in London, although it is only 26% for those who share a home.

But for those who have the flexibility to work from anywhere, there are still places where rent remains highly affordable.

For example, in Great Yarmouth in the East of England, South Somerset in the South West, and North East Lincolnshire in Yorkshire and the Humber, rents account for just 15% of joint income for a couple.

Even in London, rents in Bromley are only 19% of a typical couple’s income.

It is also worth noting that wage growth has actually outpaced rental growth since 2016.

What’s the supply and demand for rental homes like?

Demand for homes to rent remains strong across the country, particularly in city and town centres as workers return to the office.

Rental demand is strongest in Scotland, Wales and London, where levels are 68% above the five-year average.

Unfortunately, this demand is not being met by supply, which is pushing rents higher and leading to the typical property taking just 14 days to rent.

The mismatch between supply and demand is particularly acute in London, where the number of homes available to rent is currently only around half the five-year average.

The South West also faces a significant mismatch, with demand up 45%, but supply 32% lower than the long-term average.

Even in the East Midlands, where supply is least constrained at just 6% below the normal level, demand is still 43% higher.

What’s the outlook?

In the coming months, the surge caused by post-pandemic pent-up rental demand is expected to ease, which will reduce the upward pressure on rents.

Gráinne Gilmore, head of research at Zoopla, said: “Affordability considerations will also start to put a limit on further rental growth, although this may occur at different times depending on location.

“Rents are likely to continue rising for longer in areas which have the most constrained stock levels – currently London, Scotland and the South West.”

Overall, we expect rents across the UK, excluding London, to rise by 4.5% during 2022, and by 3.5% in the capital.