Some 25% (13 million) of UK adults say they expect their finances to worsen over the next three months, research from pensions and retirement specialist LV= has found.

The figures are the worst since December 2020 and highlight how the confidence of UK consumers is faltering as fears about a resurgence of coronavirus rise.

The LV= Wealth and Wellbeing Monitor - a quarterly survey of 4,000+ UK adults – reveals.

· Financial outlook: 25% (13m) expect their finances to worsen over the next three months

· Finances over past three months: 33% (17m) say their finances have deteriorated over the past three months.

· Outgoings increase: 48% (25m) say their total monthly outgoings have increased and 9% (4.7m) saying they have decreased

· Saving sentiment falls: 20% (10.5m) of UK adults said they amount they are saving has fallen

Clive Bolton, managing director of protection, savings & retirement, said: “The Covid-19 pandemic has been incredibly difficult for the nation and had a huge impact on the lives, personal finances and mental health of millions of people.

“Consumer sentiment had been steadily improving between spring and early autumn 2021 as the success of the vaccine programme, fall in death rates and easing of lockdown restrictions allowed to life to begin to return to normal. However, the appearance of the Omicron variant and rising infection levels has knocked confidence back to levels last seen in the dark days of December 2020.

“Inflation is becoming more of a problem for many people who say their outgoings have increased, particularly those who are retired. Rising prices coupled with poor returns on deposit accounts will dismay pensioners whose only or main source of retirement income is the state pension. Many will be financially squeezed as the cost of essential items like home heating rise while returns from savings accounts – which typically form the bulk of retired people’s savings – remain low. However, the economy remains relatively strong and wages are rising for those people whose jobs are unaffected by lockdowns.

“Millions of people have endured a difficult Christmas and New Year but hopefully the current booster vaccine programme will be successful and confidence will return as the virus comes under control.”

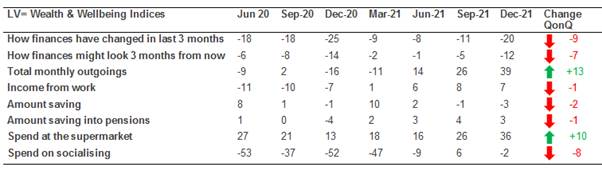

The LV= Wealth and Wellbeing Indices:

LV= uses indices to track overall changes to spending, saving and finances. The indices are calculated by: subtracting the % who stated a negative change over the past three months (e.g. decrease/ worse) from the % who stated a positive change over the past three months (e.g. increase/ better), to work out the overall impact.

The above data shows that there have been significant changes to some indices between September and December 2021.

· Finances over past three months: The index measuring people’s finances over the past three months was -20 in Dec 2021. More people say their finances have got worse over the past three months compared to Sept 2021 when the index was –11. However, the figure is the worst record since the Monitor started in June 2020.

· Financial outlook: The index measuring financial outlook for the next three months was down sharply at -12 in Dec 2021 compared to -5 in Sept 2021. A negative index means more people think their finance will worsen over the next three months compared to this who think it will improve. The figure is the worst since Dec 2020

· Income and outgoings: The index measuring income has hit 7. The index measuring outgoings also hit an all-time high of 39 with a lot more people (48%) saying their outgoings have increased compared to decreased (9%). The rise in outgoings in Q3 were partly caused by people beginning to return to work coupled with the rise in inflation that became so apparent over autumn and winter.

· Savings index: The index measuring saving has fallen to -3 in Dec 2021 from -1 in Sept 2021 and 10 in March 2021, indicating that people are spending more and saving less.

· Spending on socialising and at the supermarket: The index measuring spend at the supermarket has increased to 36 in Dec 2021, the highest figure since the Monitor began. This highlights how inflation is accounting for a higher proportion of income.