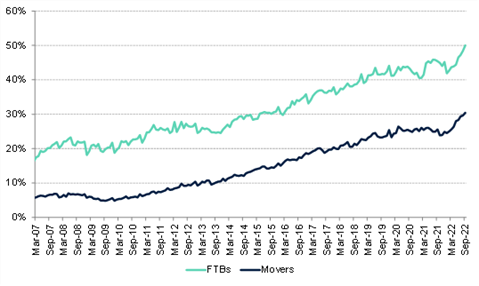

Half of all first-time buyers, and over a quarter of home movers who took out a mortgage in the third quarter of 2022 opted for a term of more than 30 years, according to UK Finance’s latest Household Finance Review.

This compares with around a quarter of first-time buyers and fewer than one in ten home movers doing so just ten years ago.

The proportion of mortgages borrowed over longer terms has increased almost continuously since the global financial crisis and accelerated sharply since 2021, reflecting the effects of rising house prices and new mortgage rates on affordability.

The data also shows that the average income of new borrowers has risen. The average household income of a first-time-buyer mortgage application in Q3 2022 stood at just under £60,000.

This is 17% higher than the same quarter last year. During this time, wage growth was well below this rate, indicating a shift towards higher income households entering the market as lower income households struggle to get onto the housing ladder.

According to the Review, house purchase activity remained on trend with pre-Covid-19 levels in Q3 this year, but demand is expected to weaken into 2023 due to stretched affordability.

Meanwhile, borrowing through personal loans dropped off in Q3 after strong growth in the first half of the year. Household savings remained static in the quarter as the rising cost of living put pressure on people’s ability to save.

Overdraft use continued to increase slightly, but because many people paid off their overdrafts during the pandemic, aggregate levels remain well below those seen before Covid-19.

Growth in outstanding credit card debt eased in Q3 following a strong previous quarter. This is likely to reflect a drop-off in discretionary spending, such as on travel.

Meanwhile, the long-term decline in interest-bearing balances stalled in the quarter, suggesting a small increase in some consumers being unable to pay off their credit card balances in full at month end.

Despite pressures on household finances, there has been no impact on headline mortgage arrears numbers in Q3. Overall arrears continued to fall in Q3; however, the burdens on household finances from falling incomes and higher mortgages could mean an uptick in arrears next quarter and into next year.

Possession numbers remain substantially lower than previous normal levels. Possession is always a last resort, and those going through the courts at the moment are historic cases relating to long-term arrears built up over a period of years.

Eric Leenders, managing director of personal finance at UK Finance, said: “The levels of home buying and selling were in line with pre-pandemic trends in Q3, but we expect activity to cool next year.

“Cost of living pressures and changing employment patterns are likely to have an impact on demand and affordability going forward.

“At the same time, 1.8 million fixed rate deals are due to end in 2023, so refinancing levels will be robust. We would encourage customers to speak to a mortgage advisor and shop around for the best deal for their circumstances.

“Lenders are here to help. Anyone who is worried about their mortgage, loan or credit card payments, should speak to their lender as soon as possible to discuss the options available to help.”

Krishnapriya Banerjee, a managing director in Accenture’s UK Banking practice, added: “Waning consumer confidence shows that people are bracing for tougher times ahead and seeking to stretch affordability.

“Banks will need to address the twin challenge of supporting households through this uncertain economic period whilst ensuring they have sufficient operational resilience to handle the weight of growing customer demands.

“Digital tools that leverage artificial intelligence and behavioural economics can be used to help anticipate customers’ needs and assist those facing financial hardship.”