House price growth accelerated in February with the average price of a home increasing by £29,000 over the past year, the latest house price figures from Nationwide show.

Overall annual house price growth increased to 12.6% in February, from 11.2% in January and prices were up 1.7% month-on-month.

February also marked the first time that the average house price exceeded £260,000 with the price of typical home now some 20% higher than February 2020.

| Headlines | Feb-22 | Jan-22 |

|---|---|---|

| Monthly Index* | 523.4 | 514.5 |

| Monthly Change* | 1.7% | 0.8% |

| Annual Change | 12.6% | 11.2% |

| Average Price(not seasonally adjusted) | £260,230 | £255,556 |

Robert Gardner, Nationwide’s chief economist, said: “Annual house price growth accelerated to 12.6% in February, up from 11.2% in January and the strongest pace since June last year. Prices rose by 1.7% month-on-month, after taking account of seasonal effects, the seventh consecutive monthly increase.

“The price of a typical home rose above £260,000 for the first time in February, an increase of £29,162 over the past 12 months.

“This is the largest ever annual increase in cash terms since the start of our monthly index in 1991. The price of a typical home is now £44,138 (20%) higher than in February 2020 – the month before the pandemic struck the UK.

“Housing market activity has remained robust in recent months, with mortgage approvals continuing to run above pre-pandemic levels at the start of the year. A combination of robust demand and limited stock of homes on the market has kept upward pressure on prices.

“The continued buoyancy of the housing market is a little surprising, given the mounting pressure on household budgets from rising inflation, which reached a 30-year high of 5.5% in January, and since borrowing costs have started to move up from all-time lows in recent months.

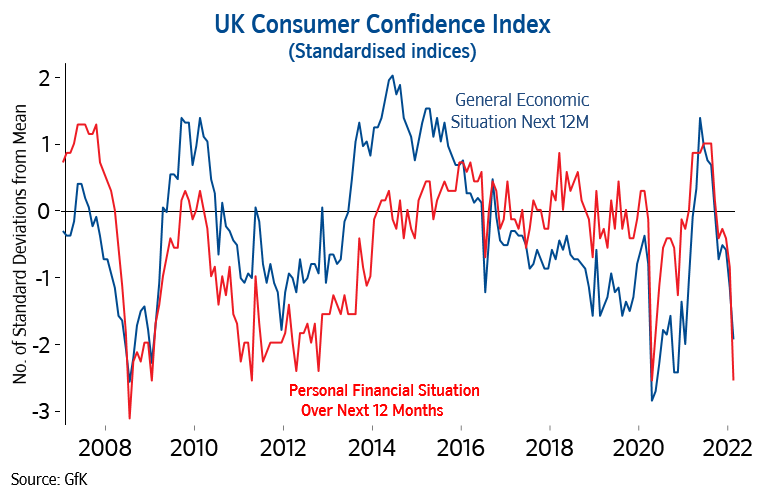

“The strength is particularly noteworthy since the squeeze on household incomes has led to a significant weakening of consumer confidence.

“Indeed, consumers’ view of the general economic outlook and prospects for their own financial circumstances over the next 12 months have plunged towards levels prevailing at the start of the pandemic, as shown in the chart below.

“The economic outlook is particularly uncertain at present. Nevertheless, it is likely that the housing market will slow in the quarters ahead. The squeeze on household incomes is set to intensify, with inflation expected to rise above 7% in the coming months.

“Indeed, there is scope for inflation to rise even further as events in Ukraine threaten to send global energy prices even higher.

“Assuming that labour market conditions remain strong, the Bank of England is also likely to raise interest rates, which will exert a further drag on the market if this feeds through to mortgage rates.

“Housing affordability has already become more stretched, in part because house price growth has been outstripping earnings growth by a wide margin since the pandemic struck.

“The price of a typical home is now equivalent to 6.7 times average earnings, up from 5.8 in 2019.”

Reaction

Tomer Aboody, director of property lender MT Finance:

“Accelerated house price growth in February demonstrates that buyers are back in the swing of things after the Christmas break.

“Competition among buyers is fierce, with multiple offers being received in many instances. Some vendors are selling before finding somewhere to move to, in order to take advantage of high prices, and opting for rented accommodation until the dust settles.

‘With interest rates rising, affordability is becoming even more of an issue, particularly for younger buyers struggling to afford their first home.

“Of course, the terrible war in Ukraine cannot be ignored, and how this might impact the UK. With purses already squeezed as the cost of living rises, the Bank of England might reconsider at its proposed interest rate increases in forthcoming months, in order to minimise the hit on consumers.”

Mark Harris, chief executive of mortgage broker SPF Private Clients:

“The very cheapest mortgage rates may be long gone, with several lenders raising rates as the general movement in money market rates is upwards but that is not putting off buyers who remain confident and keen to buy.

“Rates remain at comparatively low levels from a historical perspective, so stretched affordability has not yet become a widespread issue although if prices continue rising at this pace, it may well become more of an issue.

“With property prices continuing to rise, along with energy prices and the wider cost of living, there are fears that this won’t remain the case. But with the Bank of England announcing plans to scrap its mortgage affordability test, in theory, lenders will be able to lend more, helping first-time buyers in particular.

“Fears that banks will act irresponsibly and lend much more than borrowers can afford to repay are likely to be wide of the mark. Banks will keener to attract high-income households with relatively low expenditure, who can best afford to cover increases to their mortgage payments.”

Jeremy Leaf, north London estate agent and a former RICS residential chairman:

“Despite recent modest stock improvements, partly prompted by the rise in inflation and interest rates, the continuing overall shortage is constraining activity but supporting the acceleration in prices.

“It is probably too early to gauge the likely impact of the war in Ukraine on the housing market but not much if the first few days are anything to go by. We have already agreed several sales at fairly robust prices this week.

“The expected additional rise in the cost of living driven by energy prices and possibly interest rates will reduce confidence to take on extra debt and make buyers even more determined not to overpay.”

Phillip Stevens, director of Richmond estate agency Antony Roberts:

“While this data is behind the curve as it is based on completions, and there is probably a little more caution out there than these numbers indicate, buyers continue to face a lack of choice due to lack of stock.

“While these figures show that the national average property price is rising, the reality is there isn’t one single market – what is happening with prices is very different depending on the profile of the property. Flats without outside space are still struggling to sell and will come off in value whereas houses are few and far between and increasing in value.

“As long as there is a shortage of supply and significant demand, pricing will be bullish.”

Michael Bruce, CEO and founder of Boomin:

“We’re riding a wave of house price growth at present, driven by a market that is experiencing very high demand for homes that just simply aren’t available. It’s only natural that this wave will start to lose ferocity at some point, but there’s certainly no signs of that happening just yet, despite a squeeze on the cost of living and a double-digit increase in interest rates.”

Jonathan Samuels, CEO of Octane Capital:

“Although two consecutive increases in interest rates is always going to be food for thought for the nation’s homebuyers, what we’re currently seeing is consideration, not concern.

“While some may have marginally adjusted the sums they are committing to borrowing, the sheer volume of new buyers entering the market remains very high and this is enough to keep house prices buoyant for some time to come.”

Marc von Grundherr, director of Benham and Reeves:

“There’s arguably never been a better time to be a homeowner as, despite all that’s been thrown at it, the UK property market continues to go from strength to strength. This performance really is quite alarming when you consider the wider economic turmoil that we’ve faced for some years now and it proves that there really is no safer investment than bricks and mortar.

“Even across London where market conditions have remained far more muted, values have continued to climb and the capital’s property market is now poised to enjoy an accelerated rate of growth over the coming year.”

Chris Hodgkinson, managing director of HBB Solutions:

“Although top line market statistics paint a very positive picture, it’s important to remember that the UK property market is extremely fragmented in its nature.

“The key to a successful sale is understanding your own local market landscape, the demand for homes and pricing in accordance with these factors.

“Failure to do so and pricing too high will only see your home suffer from a severe lack of interest, a protracted period of time spent on the market and a higher chance of turbulence further down the transaction timeline.”

James Forrester, managing director of Barrows and Forrester:

“Yet another increase in property values demonstrates the current strength of the UK property market and the deafening silence coming from the usual band of property market naysayers is no better testament to this overall health.

“Despite many prophesying the end of the market due to Brexit, the pandemic and the end of the stamp duty holiday, amongst other things, we’re yet to see a chink appear in the armour of what is perhaps the most defiant and dependable property market in the world.”

Iain McKenzie, CEO of The Guild of Property Professionals:

“The housing market continues to barrel onwards like a runaway train, defying soaring inflation and plummeting consumer confidence.

“The trend of seeing record house prices every other month looks likely to continue in the short term, with the average home now costing £260,000 and having increased 20% since the start of the pandemic.

“The industry waits with bated breath for a readjustment to prices this year, but there are no signs of a slowdown after seven consecutive months of increases.

“Demand is driving this upward trend and in many areas, hordes of prospective buyers are ready and waiting for the right property to come on the market.

“Housing affordability remains a concern, and with the cost of living crisis impacting households, it is likely that price growth will have to ease at some point this year.”

Nicky Stevenson, managing director at national estate agent group Fine & Country:

“Buyers will be taking a deep breath at this latest spike in house prices.

“Rocketing energy prices, volatile stock markets, and creeping interest rates have yet to make even the smallest dent on turbo-charged house price growth.

“These heady gains are likely to continue unless we see a flood of new listings come onto the market.

“Spring is traditionally a busy time for agents, and while some expect a bonanza of new listings, for the time being the cupboard remains bare.

“This is a remarkable bull run and the prospect of any house price correction seems rather remote for the time being.”

Lucy Pendleton, property expert at independent estate agents James Pendleton:

“This just goes to show what’s possible when healthy demand meets the immovable obstacle of low stock levels.

“Buyers are still crossing swords to seal a deal and it’s getting ugly but recent world events have already rendered this startling read-out bang out of date.

“If inflation was the watchword before the Ukraine crisis, it is now this market’s North Star. Russia’s invasion has sent already hot commodity markets into meltdown, creating a tidal wave of effects that threaten to bind the economy to a steady succession of interest rate rises.

“This is likely to weigh on house price growth nationally in the coming months, particularly in those areas that have seen the biggest increases over the past year and a half, but it will also encourage prospective buyers to move their plans forward to beat higher borrowing costs.

“The long rally that the UK has experienced since the summer of 2020 was always going to end with some sort of economic trigger. Stock markets have reacted badly to this humanitarian disaster and consumer confidence is suffering, with the cost of living going up and borrowing costs rising.

“However, it doesn’t necessarily follow that the housing market will go into retreat because we still exist in a low interest environment. The question of whether the market will still be growing in 12 months’ time remains finely balanced but it would be remarkable if the days of double digit annual price growth weren’t soon to be at an end.”

Jonathan Hopper, CEO of Garrington Property Finders:

“No one expected this. Tight supply has continued to breathe new life into this rally and produced an extraordinary jump in February but this could all be about to change.

“The market has started to loosen up a bit as those wanting to move in the spring have begun to list their homes in greater numbers.

“This is the unclogging that buyers at both ends of the spectrum have been waiting for. First-time buyers have seen affordability stretched to breaking point by the bunfight over slim pickings while those transacting on prime property have also been shy to list because of a lack of choice.

“Once the market has rounded this corner and stock levels improve, price growth could start to soften. But while this is a step in the right direction after the desperate supply shortages of the past year, competition remains extremely stiff for homes in the most desirable areas.

“The most sought-after properties are selling in days, if not hours, and some sellers are still subjecting would-be buyers to a beauty pageant, dispensing with the usual niceties of offers and counteroffers, and instead jumping straight to ‘best and finals’. This means many buyers are still having to be very tactical.

“It’s also the case that, despite recent consensus that inflation had bought the housing market a one-way ticket to slower growth, the war in Ukraine has made this less certain.

“This time last week, it was widely held that rising interest rates would soon take the steam out of house price inflation. Now all bets are off, as financial markets drop hints that the West’s sanctions on Russia may prompt the Bank of England to hike rates more slowly. This could extend the pandemic property boom a little longer.”

Ross Boyd, founder of the always-on mortgage comparison platform, Dashly.com:

“The property market is absolutely flying but there is turbulence ahead. As the latest Bank of England mortgage approvals data showed, demand for property remained very strong at the start of the year, surprisingly so given the growing cost of living crisis.

“Two years on from the start of the pandemic, the race for space is still real and this seismic change in property requirements continues to fuel demand.

“First-time buyers are as keen as ever to get out of the rental market and onto the property ladder, as it’s usually cheaper to own if you can find the deposit.

“The major challenges facing the market right now are a scandalous lack of stock, interest rate rises and the surging cost of living. Many households are starting to feel the pinch and lenders are looking at affordability in ever greater detail, and this is likely to see the market slow as we progress through the year.”

Scott Taylor-Barr of Shropshire-based broker, Carl Summers Financial Services:

“The UK property market is a law unto itself. The fact that average prices are 20% higher than two years ago, at the start of a global pandemic pandemic, is borderline fantastical. Interest rate rises and the increase in the cost of living clearly haven’t impacted the property market yet, with people still keen to get onto, or move up, the ladder.

“However, as the year progresses, rate rises, tax hikes and the spiralling cost of living are going to bite, with lenders’ affordability calculators likely to become less generous and borrowing rates heading north.

“This means that, even though first-time buyers may still be motivated to buy, they perhaps won’t be able to just yet. We’re unlikely to see house prices fall due to the abject lack of stock but it’s hard to see this rate of growth continue during 2022.”

Rob Gill, founder of London-based Altura Mortgage Finance:

“February saw the property market once again defy logic, as demand remained robust. First-time buyers, in particular, have been taking advantage of decreased competition for flats, especially those without outside space, as families seek to trade up for more space in the post-pandemic era.

“Flats also have less competition from landlords who have faced an increasing squeeze in recent years from lower tax breaks and higher regulatory costs.”

Toby Fields, co-founder of Bristol-based Langley House Mortgages:

“The largest ever annual increase in cash terms in over 30 years is frankly mind-boggling and is almost certainly being caused by the radical imbalance between supply and demand.

“Though the cost of living and interest rates are rising, the one thing that isn’t is the number of houses for sale. Frighteningly low stock levels are supporting prices and keeping the market strong.

“While the economic fundamentals should be weighing down on it, the property market remains as robust as it has been throughout the pandemic. The only way prices will fall is through a surplus of supply and that’s unlikely any time soon given the glacial pace at which we build new homes.”

Lewis Shaw, founder of Mansfield-based Shaw Financial Services:

“Despite February’s exceptional performance, 2022 is set to be the year of the Great Remortgage rather than the great home move.

“The lack of stock will hinder transaction levels and growing concerns about the cost of living and rate rises mean more would-be movers will be inclined to sit tight and remortgage rather than move. There’s been a noticeable increase in remortgaging due to consecutive base rate rises and people’s concerns about the skyrocketing cost of living.

“It’s likely mortgage affordability will be impacted once the National Insurance tax rise comes into effect and energy prices rise further. And let’s not forget the fact that the Bank of England raising the base rate again in March when the Monetary Policy Committee meets is an odds-on certainty.”

Amanda Aumonier, head of mortgage operations at online mortgage broker Trussle:

“While it’s good news that house price growth remains steady, homeowners are continuing to face increasing pressure on everyday bills. Alongside the overall increase on household bills, the past week has seen petrol and diesel prices rise significantly – something that may hit those saving for potential house deposits.

“As people take stock of their current financial situation and manage the increased cost of living, this could impact the pipeline of homebuyers, decreasing the demand on property and the likelihood of bidding wars which could, together, halt any further growth in house prices.

“The next few months of house price growth will be intrinsically linked to the overall economic picture, with household expenditure likely to put the squeeze onto disposable income, and in turn deposit-saving potential.

“And whilst many will see The Bank of England’s proposal to abandon rules which force lenders to apply strict stress tests to borrowers as a step closer to their dream home, it is important to be cautious of today’s climate – ultimately this could lead to a further stretch on homeowner finances.”